ICYMI— Recap of March’s Bank & Brews – Don’t Quit Your Day Job…Yet

By: Sam Brown

Entrepreneurs struggle with the burning question–when is the right time to quit my day job? What if I quit too early? Or the real zinger question: What if I quit too late? No matter how many Enneagram tests you take, the decision to quit your day job is one of the toughest decisions an entrepreneur makes.

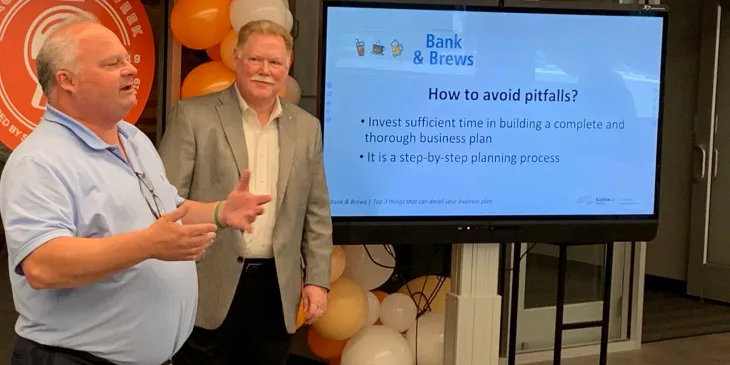

That’s why our March Bank & Brews workshop focused on the top three things you need to do BEFORE quitting your day job and talking to a bank! Below is a recap of what we talked about:

1. Identify what type of business you are creating (S Corp, LLC, Sole Proprietorship)

Have your entity formed (or at least know how it will be formed)

Know how your business is going to pay taxes

Bring your formation documents with you to the bank

TIP #1: If you file for a DBA, remember to file paperwork with both the County & Texas.

2. Have realistic numbers and projections

Show the bank how your business will succeed using realistic and defendable predictions

Bankers primarily base decisions on historical data, which is why startups struggle for funding

Remember the bank’s #1 concern is the repayment of your loan with them

TIP #2: Generally, a startup or new business won’t be profitable for the first 1-2 years. You need to plan for that in your numbers.

3. Keep your day job

Your day job may provide the secondary source of loan repayment that allows for your loan to be approved

Rent/lease a location vs. purchasing to minimize your start-up expenses

Leasing equipment can also help minimize startup expenses

Consider 6 months of running your startup to test its proof of concept before you ever go to talk to the bank

Keep as much money as you can for cash flow for the business

TIP #3: Startup loans are not meant to cover your personal expenses, which means you have to have another source of funding to cover your personal needs.

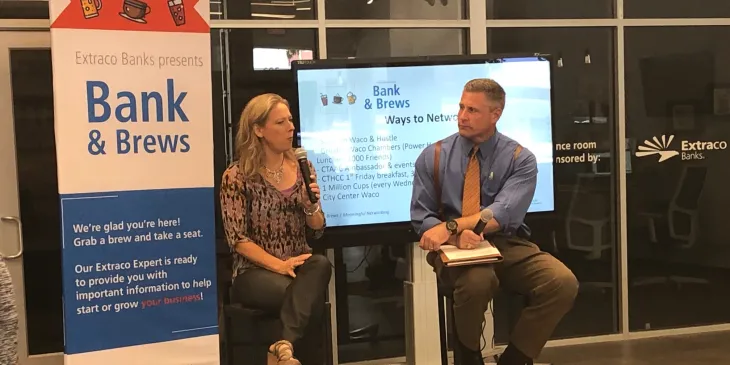

We had the pleasure of welcoming the Brotherwell Brewery owners and head brewers, David and Jacob. They gave attendees great insights on their entrepreneurial journey:

1. Work-life balance is super important

2. Scale growth of business with demand

3. Know what products meet the needs/demands of your audience

We’re so thankful to David & Jacob for being our guests! Y’all can try their (delicious) beer every Saturday from 11AM-5PM at their Brewery located (400 E Bridge St) or go to one of Waco’s restaurants that have their beer on tap! My favorite is the Triple, and we’ve heard that the Whit and Ale are pretty good too. You can learn more about Brotherwell by visiting their Facebook page!

Information about Bank & Brews

In partnership with Start Up Waco, Bank & Brews is designed for anybody who wants to learn more about starting or growing a business! These monthly events are free and hosted at Hustle Co-working space. Visit Extraco’s Facebook page to learn more about upcoming Bank & Brews!

About Extraco Banks®

Extraco Banks and its affiliate companies are dedicated to building people, businesses and communities. Since the Great Recession, Extraco has extended over $2.5 billion in loans to 25,000 customers, while financially supporting over 1,275 community organizations working to create economic vibrancy, job growth and overall quality of life to our communities across central Texas. Founded as a cotton warehousing company, Extraco, at $1.4 billion in assets, is the largest and most comprehensive locally owned bank between Dallas and Austin, serving over 120,000 customers’ banking, mortgage, insurance and wealth & trust needs with creative and innovative excellence. Learn more at: https://www.extracobanks.com/.