Our Extraco eBank platform offers two ways of connecting your other bank accounts– linking accounts or adding external accounts. Depending on what actions you want to take with your accounts, one may be better than the other.

Linking Accounts

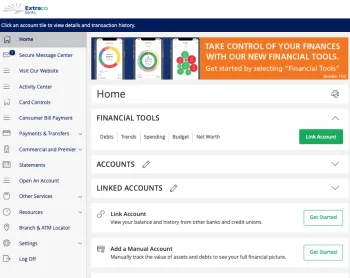

On the home page of eBank, you will find a section called Link Account. When you link an account, you will be able to view your balances and history from other banks and credit unions. This would be the best option if you just want to keep an eye on your accounts in one place.

To link an account, follow these steps:

- Go to your eBank home page and scroll down to Link Account. Press the Get Started button.

- You may be prompted to begin using Financial Tools. These tools will allow you to see your spending and create budgets for your Extraco AND non-Extraco bank accounts.

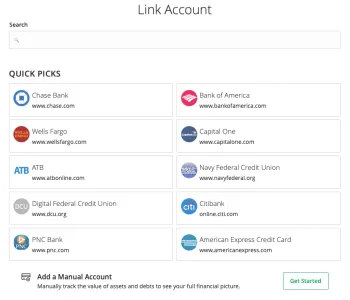

- Next, you will choose which accounts to link. You can either search for your financial institution name OR select from the options available. If you do not see your financial institution listed, you can add a manual account. This will allow you to track a specific value of assets or debts in outside accounts.

- Select your financial institution and follow the prompts to log in and link the account. You may need to answer any additional security questions the financial institution requires. It may take some time to process, but you can go ahead and add additional accounts while you wait.

- Once you’ve linked the account, you will be able to see the balance as well as transaction history. Please note: you will NOT be able to make transfers between your linked account and your Extraco account. This method is meant to just show your accounts and for you to have the ability to include them in your budgets or asset summaries.

Adding External Accounts

If you want to be able to make electronic transfers between your Extraco accounts and external accounts, you will follow these following directions:

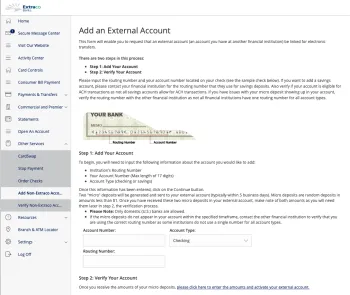

- Once logged into eBank, expand the menu on the left-hand side. Once open, select the Other Services option, and then choose Add Non-Extraco Account.

- There are two steps required to add an external account. First, you’ll need to add the account itself using the account number, routing number, and account type. The routing number and account number can be found on a check for that account or likely on your online banking account for that financial institution. You will need access to this account, as once you fill in the details, two “micro deposits” of less than $1 will be sent to the account. You will need these accounts for the next step– verification. Please note: it can take up to 3 business days for the micro deposits to appear.

- To verify and activate the external account on Extraco eBank, you will need to enter the micro deposit amounts that were made after you completed step 1. To activate, select the menu option on the left-hand side of eBank, select Other Services, and then choose Verify External Account.