Your Money, Our Priority: Keeping Your Funds Safe and Secure

Financial markets fluctuate, sometimes a little and other times a lot. However, they also vary when negative things happen, like Silicon Valley Bank's and Signature Bank's recent failures.

We get it, and we’re here to assure you that your money is indeed safe with Extraco Banks. Our bank remains extra strong and secure, and keeping your funds safe is our top priority. So, let’s go over how we protect your funds from market volatility and other threats; it begins with purposeful banking practices.

Sensible Lending Practices

Have you ever loaned money to a family member, friend, neighbor, or co-worker? Then, when it’s time for them to repay you, maybe all you heard was crickets, excuses, or nothing. This situation happens to many people and for many reasons, which is why it’s essential to carefully evaluate whether it makes sense to lend money to someone.

If you choose to lend money, you expect prompt repayment according to the terms you set up initially. We call this “lending best practices.”

For banks, lending practices mean many things, including:

- Who do you lend money to?

- Why do you lend money?

- How likely are they to repay the loan?

How Banks Operate

Other things play into lending practices, too, like how banks operate and manage. For example, customers deposit cash, and banks invest and lend money to earn more for borrowers like you; this can help us offer you higher interest yields for your savings and lower interest rates for loans.

As with everything, there is a right and wrong way to do this. You don’t want to risk too much. That’s what happened with Silicon Valley Bank. Too many of their deposits were with one particular group of people, resulting in 90% of their deposits being unprotected.

How Your Money Is Insured

The FDIC insures deposits up to $250,000 for individual accounts and up to $500,000 for joint accounts. Most American deposit accounts fall under $250,000, meaning they are insured at FDIC Member banks. The uninsured accounts at Silicon Valley Bank were primarily venture capitalists – businesses.

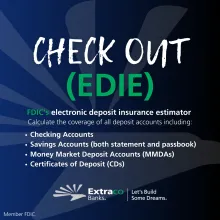

(EDIE)

Check out FDIC's electronic deposit insurance estimator:

- Checking Accounts

- Savings Accounts (both statement and passbook)

- Money Market Deposit Accounts (MMDAs)

- Certificates of Deposit (CDs)

What happened with Silicon Valley Bank?

If you heard the news about Silicon Valley Bank, you may already know what happened. But if not, here’s a basic recap.

Silicon Valley Bank had many unusual banking and lending practices that most banks do not have:

- They catered primarily to venture capitalists.

- Most of their deposits were uninsured by the FDIC.

- About 56% of their loans included “unidentified” securities.

Remember that securities can decrease in value and increase the risk of return and repayment for the bank. While most banks issue securities-backed loans, it’s a much smaller percentage than this, so the risk is minimal.

Extra Safe, Extra Strong, Extra Secure

At Extraco, we do things differently: sincerely, purposefully, and with world-class stability.

Bank with the best.

Sources

- https://www.sandiegouniontribune.com/opinion/editorials/story/2023-03-16/sd-silicon-valley-bank-signature-first-republic-bailout-failed

- https://www.federalreserve.gov/supervisionreg/enforcementactions.htm

- https://www.extracobanks.com/resources/about-extraco/community-impact

- https://www.kiplinger.com/investing/604714/is-securities-based-lending-a-good-idea

- https://www.fdic.gov/resources/supervision-and-examinations/consumer-compliance-examination-manual/documents/4/iv-1-1.pdf

- https://www.nbcnews.com/business/business-news/unusual-lending-practices-silicon-valley-bank-rcna75252

- https://www.svb.com/startup-insights/venture-debt/how-does-venture-debt-work

- https://www.nbcnews.com/tech/tech-news/svb-failure-tech-industry-blamed-collapse-rcna74633