Extraco LINC powered by Extraco Banks is excited to partner with Fundica! Fundica is a powerful tool that enables entrepreneurs and small businesses to access funding opportunities such as grants, tax credits, accelerator programs, loans, and more. This step-by-step guide will walk you through the process of using the platform to explore funding options, submitting applications, and connecting with potential investors.

Any business that is incorporated or planning to incorporate can sign up to Extraco LINC x Fundica; this includes startups as well as medium and large-sized corporations in all industries.

Let's get started!

Step 1: Accessing the Extraco LINC x Fundica Platform

1. Open your web browser and visit Extraco LINC x Fundica

2. If you don't have an account, click the "Sign Up" or "Register" button to create a new account

3. Fill in the required information and follow the prompts to complete the registration process. Required information includes:

- Zip code

- Year of company creation

- Industry (select up to 3. This refers to the industry you identify your business aligns with)

- Number of full-time employees

- Revenue in the last year

- Your email address

4. Once all above information is filled out, you’ll be asked to create an account password before pressing submit

Step 2: Navigating the Dashboard

1. Once you have successfully logged in, you will be redirected to the platform's dashboard

2. Familiarize yourself with the different sections and features available on the dashboard, such as funding opportunities, investor profiles, and application management

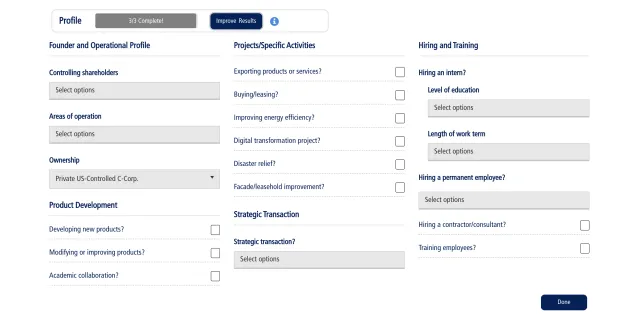

3. Take the opportunity to strengthen your profile by filing out the new blank and drop-down boxes on this page. These include questions about race, gender, age, number of controlling shareholders, areas of operation (HR, sales, marketing), and ownership (private, cooperative, individual). It then offers yes or no checkboxes for four detailed categories:

- Product Development

- Projects/Specific Activities

- Strategic Transaction

- Hiring & Training

Step 3: Exploring Funding Opportunities

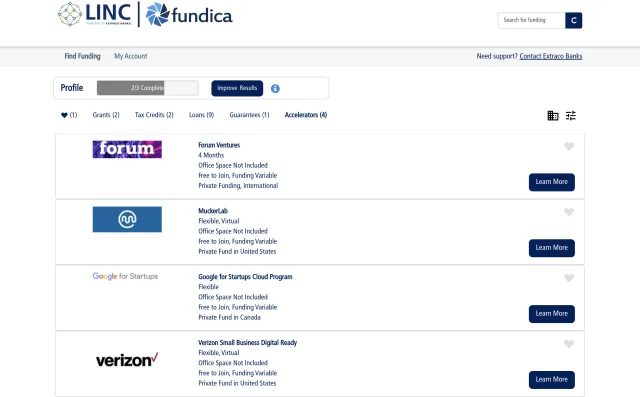

1. Click on the "Funding Opportunities" tab or section on the dashboard

2. Browse through the available funding options, including grants, loans, and tax credits

3. Utilize the search and filter functions to narrow down the options based on your preferences and eligibility criteria

4. Click on each opportunity to view detailed information, requirements, funding limits, and application procedures

5. If interested, follow the instructions to apply for funding directly through the platform

Step 4: Preparing Your Application

1. Review the requirements and criteria of the funding opportunity you are interested in

2. Gather all the necessary documents and information, such as your business plan, financial statements, and supporting documents

3. Each offered program has a guidelines PDF along with an application form attached that detail exactly what the applicant needs to submit. Use these to create a compelling, accurate, and no-nonsense pitch that highlights the key aspects of your business

Step 5: Networking and Collaboration

1. Leverage the platform's networking features to connect with entrepreneurs, investors, and industry experts

2. Join relevant discussion groups and forums, also known as Accelerator programs, for the opportunity to be mentored and expand your network

3. Engage in meaningful conversations, share insights, and build mutually beneficial relationships

Step 6: Monitoring and Managing Activities

1. Regularly check your notifications and messages for updates on funding or investment opportunities as well as new collaborative connections

2. Keep track of your ongoing applications, investments, and collaborations through the platform's dedicated sections

3. Update your profile and project information as needed to reflect any general changes or progress

Once you’ve made your account, in addition to all the programs and resources now readily accessible, Extraco Banks’s Small Business Bankers are also available to assist you in your search for funding. Here at Extraco, we invite you to take advantage of these resources to enhance your financial knowledge and improve your business strategies. Small businesses are the cornerstones of local communities, and we are committed to helping build businesses throughout central Texas.